We spotted this recent article which we thought might be of interest to you.

Last week, the Treasury announced that the Royal Mint won’t get any business this year.

A HM Treasury Spokesperson said on the 25 July 2024, “We are confident that there are enough coins in circulation without the need to order more.”

This is the first time in history that no coins have been ordered. Well, according to the article by Gary Lugg, 7iM Senior Business Account Manager, there are implications!

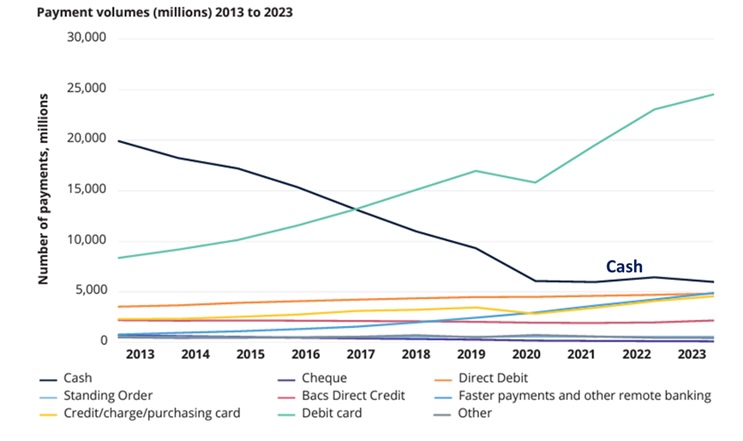

Firstly Cash is no Longer King. The graph below shows how payments have been made over time.

Source: UK Payment Markets Summary 2024, UK Finance

And while cash isn’t going away (12% of all transactions in 2023), it certainly isn’t growing and there are already ~27 billion coins of various types in circulation.

There are even rumours that 1p’s and 2p’s could be scrapped completely*. Have 5p as the smallest denomination. Tidy it all up a bit. All prices in multiples of 5. Very nice.

Actually, there is something more serious about the move away from cash. The psychology of it.

When we hand over cash we experience a psychological effect called “pain of paying”. We get a real, biological increase in our pain receptors from handing over something physical. It actually HURTS.

And that pain isn’t there with a credit or debit card – because we don’t see or feel the money leave our account.

Quite simply, paying on card makes us more likely to SPEND MORE – various studies** have found that people using a card spend nearly twice as much as people paying cash for the same shop.

So, to go back to clichés, if we remove pennies from the system, there really is a chance that the pounds won’t look after themselves!

*The last time this happened was with the halfpenny coin in 1984, which was so hated that a Conservative MP noted: “Most people don’t even bother to pick them up when they drop them,” he said. “They are glad to be rid of them.”

**Greene, C & Schuh, S. The 2016 Diary of Consumer Payment Choice, 2017/ Prelec, D Always Leave Home Without It: A Further Investigation of the Credit-Card Effect on Willingness to Pay, 2001

***Written by Ben Kumar, Head of Equity Strategy, Investment Management

If you would like to discuss any of the above as it relates to the rest of your financial circumstances please get in touch. You can call us on 0131 226 6700

The Financial Conduct Authority does not regulate Tax Planning.

The value of an investment may go down as well as up, and you may get back less than you originally invested. Past performance is not a reliable indicator of future returns.