If you are already a RobMac client or follow our financial commentaries, you’ll know that we always take the long-term view about investments or any form of financial planning for the future. And there is a good reason for this which is, although financial markets fluctuate, they do tend to climb over time.

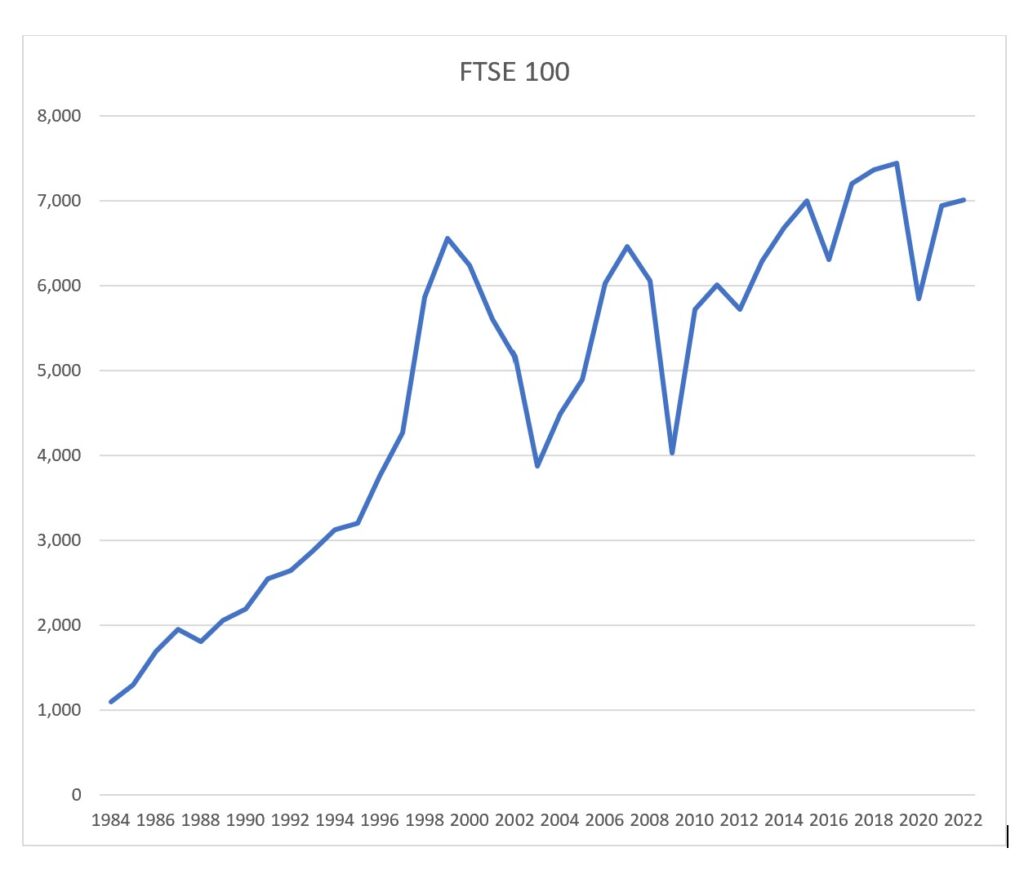

The graph below looks at the FTSE 100 since April 1984 up until October 2022. As you can see, there have been plenty of peaks and troughs over the last 38 years, triggered by various global events. But taken over the piece, the share index has risen from 1,096 in 1984 to just under 7,000 today. We can see that the FTSE has compounded by 5% per annum. With dividends re-invested the compound return would be just over 7% per annum. So, the argument for staying in the market over the long term holds good. There can’t be many better returns on investment than that – certainly not the banks.

This graph doesn’t tell the whole story because investors won’t just have shares in companies that are in FTSE 100, but as a general indicator of the stock market’s performance, it is the one usually referred to. The FTSE 100 is a published list of the top 100 publicly listed companies in the UK. The FTSE 100 index along with other stock market indexes such as the FTSE 250 can change significantly over time.

Of course, this graph doesn’t tell the whole story. For example, the companies that were in the FTSE 100 in 1984 will be very different from the ones that are in it now. So, while the overall growth is impressive, it still requires the investors to adjust their portfolios to include the companies that are performing well over time. The FTSE hit a high 6,552 in 1999 on the strength of a bull market for internet and tech stock only to collapse to 3,287 in March 2003 which coincided with the Iraq war. The FTSE had almost halved in 4 years.

The same happened again in 2008 with the global financial crisis triggered by the subprime mortgage crisis in the US and the UK went into recession for 5 consecutive quarters.

In the intervening years we’ve experienced a global pandemic, seemingly constant geopolitical turmoil including a war in Ukraine and changes of government in the UK. And yet despite this the FTSE is on or about the 7,000 mark.

There are of course times when any investment might need to be realised, but if a longer-term view can be taken then there is a good chance that investors will greatly improve their chances of earning good returns.

So, if you would like to discuss the power of compounding and long-term investing both in the UK and abroad then please get in touch.

If you are interested in learning about what makes RobMac different and think that we can help, then please get in touch. If you would like to discuss your financial position or mortgage further, you can arrange to meet online with one of our financial advisers. You can call us on 0131 226 6700.